who pays sales tax when selling a car privately in michigan

The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. A recent study by.

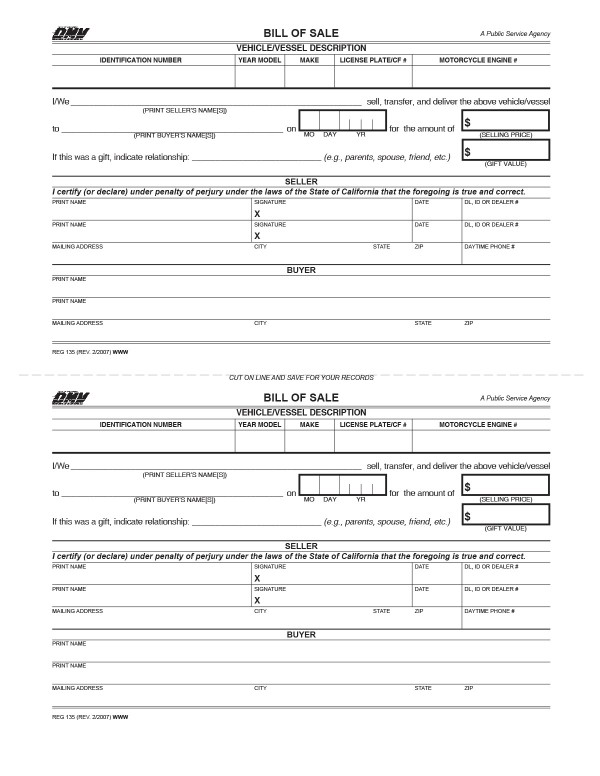

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

You can avoid paying sales tax on a used car by meeting the exemption circumstances which include.

. SAN ANTONIO CVS is paying the pink tax on some menstrual products as well as the actual sales taxes in states that will allow it the chain announced. Michigan collects a 6 state sales tax rate on the purchase of all vehicles. Michigan requires a 6 use tax be paid by the seller on all private vehicle sales unless you are transferring the title to someone with a tax exempt status.

After all a title transfer comes with fees and. It is needed whenever you buy a car from a private seller as opposed to a dealer. For example theres a state sales tax on the purchase of automobiles which is 725 and additional county taxes apply.

When the excitement winds down you and your giftee will need to sit down and determine the logistical details of the car. In addition to taxes car purchases in Michigan may be subject to other fees like registration title and plate fees. That depends on the sate and the laws regarding sales tax.

Answer 1 of 9. What transactions are generally subject to sales tax in Michigan. You will register the vehicle in a state with no sales tax because.

Toyota of Naperville says these county taxes are far. You will only have to pay 6 sales tax on 28000. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

It should contain important information including the purchase price of the vehicle the sale date a. As an example if you purchase a truck from a private party for 10000 then you will pay 6 of that amount to. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the.

To calculate how much sales tax youll owe simply. Thats why the fact that the sales tax will go on the federal governments website next month is the most important thing happening in Washington right now. A sales tax is required on all private vehicle sales in Michigan.

Youll need to have the title sales tax form and other paperwork which varies according to the situation. In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a. Who pays sales tax when selling a car privately in Illinois.

Who Pays Sales Tax When Selling A Car Privately In Illinois. The buyer will pay sales tax on the purchase price. Key Takeaway When buying a car in Michigan the trade-in.

Michigan By Kristine Cummings August 15 2022 August 15 2022 If the Vehicle Is Financed You can deduct the sales tax on vehicles you buy whether you pay the full amount. Private vehicle transactions in Michigan require a 6 tax due on the full purchase price or fair market value of the vehicle whichever is greater. This makes the trade-in option even more valuable and rewarding.

The Michigan Department of Treasury. In some states used car sales are sales tax free theory that sales tax collected when sold new not double taxing in. For vehicles worth less than.

Title transfers must take place within 30 days from the date of sale otherwise a late penalty fee will be charged. Selling a Junk Car in.

New And Used Car Sales Tax Costs Examined Carsdirect

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

How To Register For A Sales Tax Permit In Michigan Taxvalet

All About Bills Of Sale In Ohio Forms Templates Facts Etc

Texas Used Car Sales Tax And Fees

All About Bills Of Sale In California The Facts And Forms You Need

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Tax Laws By State Ultimate Guide For Business Owners

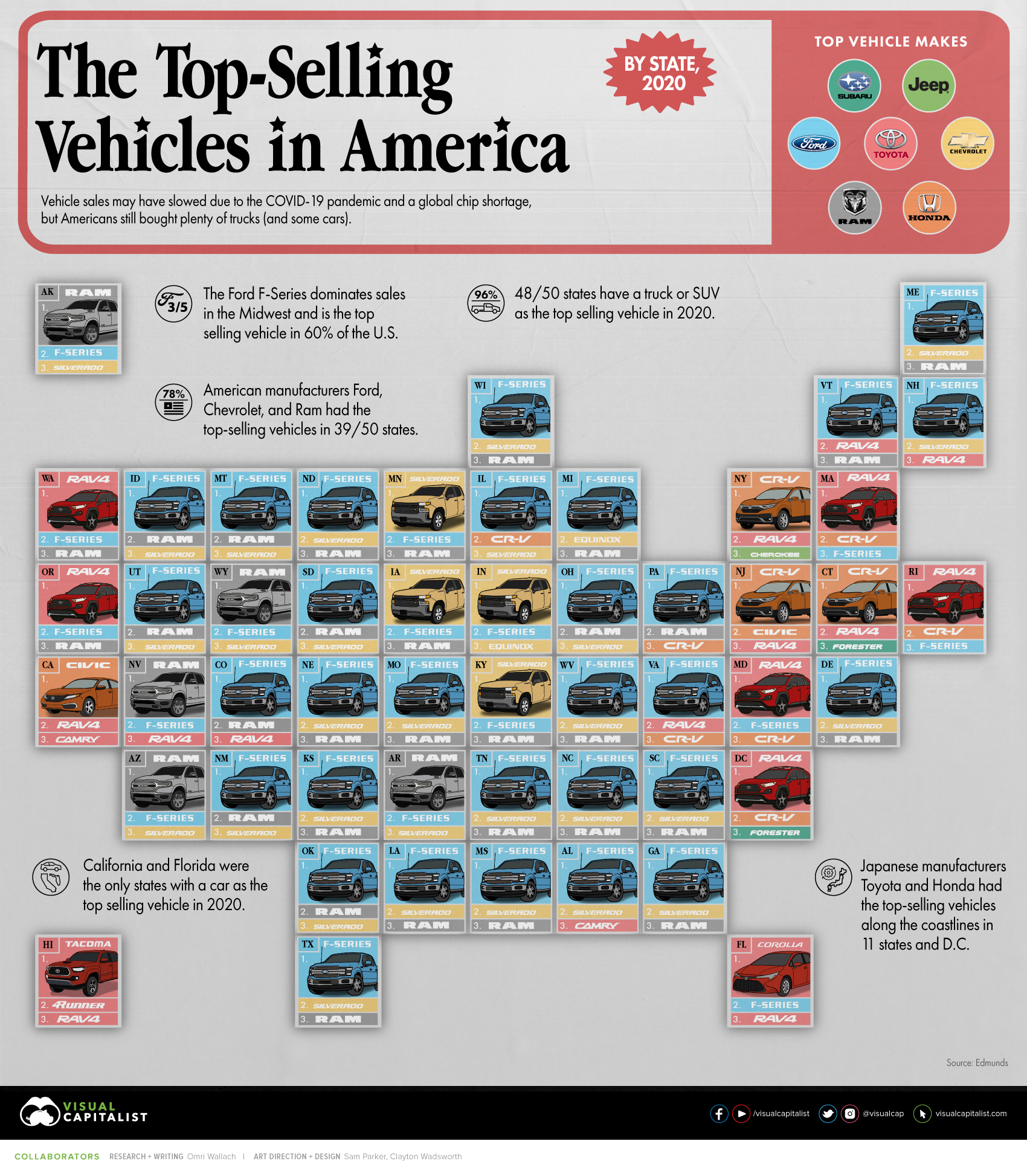

The Best Selling Vehicles In America By State Visual Capitalist

Do I Need To Pay Taxes On Private Sales Transactions Rocket Lawyer

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

States With No Sales Tax On Cars

Strange Michigan Law No Car Sales On Sunday

Understanding Taxes When Buying And Selling A Car Cargurus

![]()

Michigan Vehicle Registration And Title Information Vincheck Info

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

:max_bytes(150000):strip_icc()/BillofSale-d0a63400e8c942cab9b481536629f278.jpeg)

How To Write A Bill Of Sale For A Car

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

From Retro To High Tech Michigan Drivers Snap Up New License Plate Options Bridge Michigan